how do i pay my personal property tax in richmond va

Be it property taxes utility bills tickets or permits and licenses you can find them all on papergov. Based on the type of payments you want to make you can choose to pay by these options.

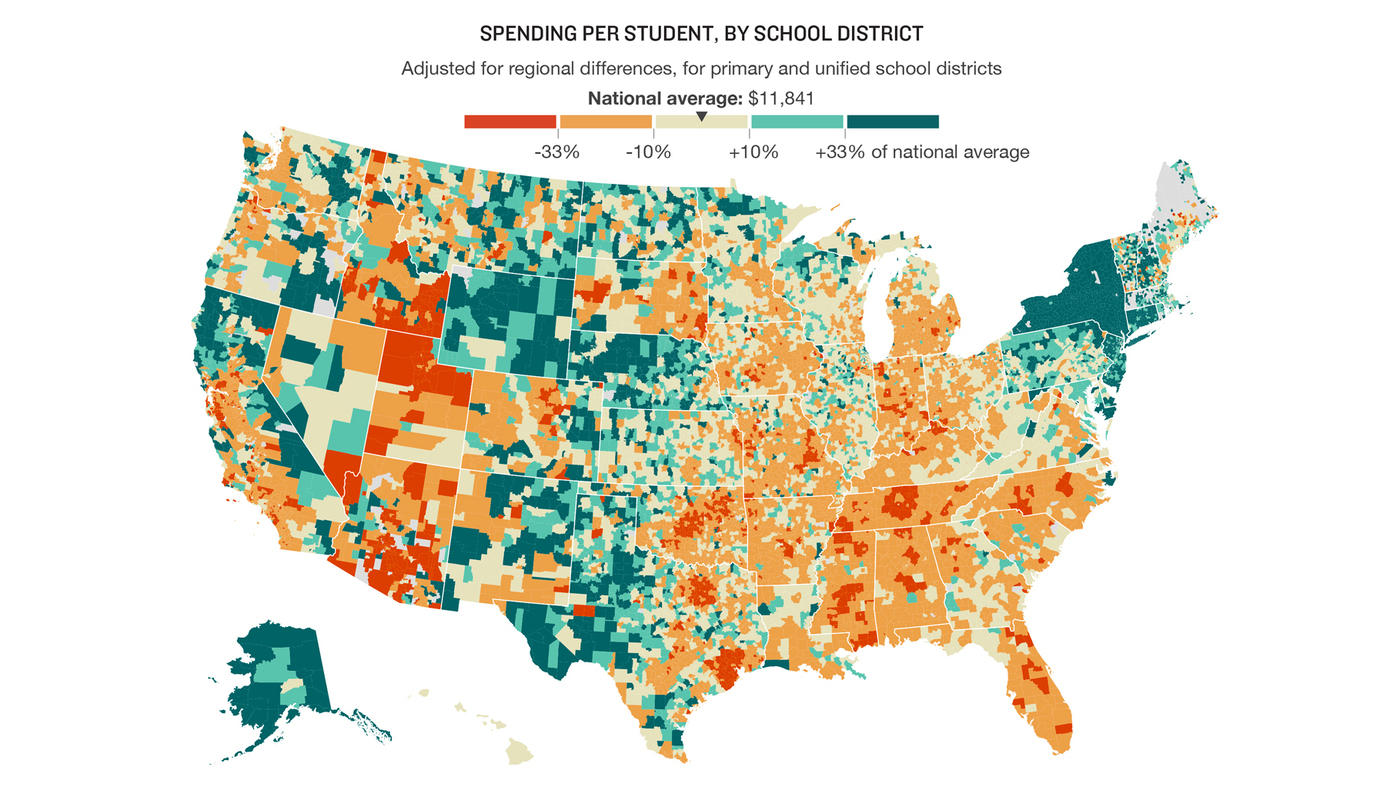

Population Wealth And Property Taxes The Impact On School Funding

350100 x 10000.

. The Virginia Tax Code Section 581-3518 requires all business owners including home-based businesses to file a Business Tangible Personal Property Return and current asset list. Pay Personal Property Taxes Online in City of Richmond seamlessly with papergov. Homeowners in the state of Virginia pay property tax rates that are well below the national.

757-393-8000 Monday-Friday 8 am. Pay your bills online. Pay Real Estate Tax Online in City of Richmond seamlessly with papergov.

A 10 penalty and interest of 10 APR will be assessed on the day following each due date. The current rate for Personal Property Taxes is 4. You can pay your personal property tax through your online bank account.

Use account information from your Property Tax Notice. Also if it is a. By linking your Property Account to your MyRichmond account you will.

Click on Continue to Pay Personal Property Taxes link at the top or bottom of this page. Administrative fees DMV stop fees lien fees and. Emailed receipts provide electronic payment history without the paper.

Personal Loan Rates. Example Calculation for a Personal Use Vehicle Valued at 20000 or Less. Directly from your bank account direct debit ACH credit initiated from your.

On the first screen enter your email address and then press OK. Prepayments are accepted if you would like to make payments in advance of the due date for real estate and personal property taxes. Payment of Delinquent Taxes with a DMV Stop.

There are certain requirements they must meet to. You can call the Personal Property Tax Division at 804 501-4263 or visit the Department of Finance website. How Do I Pay Personal Property Taxes.

Apply the 350 tax rate. Senior citizens and totally disabled persons have the right to apply for an exemption deferral or reduction of property taxes in Virginia. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as.

A service fee is added to each payment you make with your card. Schedule one time or periodic automatic payments with Flex-Pay. Portsmouth City Hall Contact Us 801 Crawford Street Portsmouth VA 23704 Phone.

When do I need to file a personal property return for my car or pickup. Be it property taxes utility bills tickets or permits and licenses you can find them all on papergov. Personal Property Tax.

The City of Danville offers a variety of ways to pay your Personal Property Taxes. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for. Pay using a credit or debit card through Paymentus choose Individual Estimated Tax Payments.

Please call the office for details 804-333-3555. Assessed value of the vehicle is 10000. 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am.

When you use this method to pay taxes please make a separate payment per tax account number. The personal property tax rate set annually by City Council is 345 per 100 of assessed value or 345 except for Aircraft which is taxed at a rate of 106 per 100 assessed value or 106. Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxes include creditdebit cards e-checks scheduled payments and automatic payments Auto-Pay.

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

How To Find Tax Delinquent Properties In Your Area Rethority

Henrico Leaders To Vote On Personal Property Tax Bill Extension

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Pay Online Chesterfield County Va

Population Wealth And Property Taxes The Impact On School Funding

Property Taxes How Much Are They In Different States Across The Us

How School Funding S Reliance On Property Taxes Fails Children Npr

Richmond Property Tax 2021 Calculator Rates Wowa Ca

The Hidden Costs Of Owning A Home

Soaring Home Values Mean Higher Property Taxes

How School Funding S Reliance On Property Taxes Fails Children Npr

Frustrations Rise In Henrico As Personal Property Tax Bills Increase